Rewarding Healthy Financial Behavior

Product Manager Case Study

problem statement

Monorail needed to increase user motivation and long-term engagement through gamification without encouraging risky behavior, overstating returns, or violating financial regulations. The core problem was designing progress and rewards that educate and build trust—while remaining fully compliant and aligned with responsible, values-based investing.

Objectives

- Increase engagement through compliant, trust-building gamification

- Align motivation mechanics with values-based, long-term investing

- Maintain regulatory integrity while improving user experience

Goals

- Design a tiered progress system that rewards responsible actions

- Embed gamification across onboarding and core product flows

- Create scalable patterns that support future growth and portfolios

my process

From Insight to Impact

Define the Constraints

Aligned early with compliance, design, and engineering to set guardrails around risk, regulation, and user trust.

Design for Behavior

Focused on motivating long-term investing behaviors by validating mechanics against compliance and user impact.

Ship and Validate

Delivered reusable patterns embedded into core flows, enabling the framework to scale with minimal rework.

Qualitative Research & Ideation

We analyzed gamification patterns using shared whiteboards, workshops, and AI-assisted ideation. This clarified which engagement mechanics supported trust and compliance.

Key Observations

- Reviewed gamification patterns from consumer investing apps such as Robinhood and Stash, capturing screenshots and annotating strengths and risks during team reviews.

- Shared and synthesized examples using digital whiteboards in FigJam, enabling rapid comparison of mechanics, language, and visual cues.

- Used AI-assisted ideation tools to explore alternative progression models, reward framing, and compliance-safe language.

- Conducted cross-functional ideation workshops and roundtable discussions with product, design, engineering, and compliance teams.

Inferences

- Many popular fintech gamification patterns prioritize urgency and dopamine over clarity, creating compliance and trust risks if reused directly.

- Collaborative visual analysis helped the team quickly distinguish between engaging patterns worth adapting and mechanics that needed to be avoided.

- Combining AI-assisted exploration with human-led workshops accelerated idea generation while keeping final decisions grounded in product judgment, regulatory awareness, and user trust.

user needs

Defining Real User Needs

Meaningful Progress

Clear visibility into progress that reinforces responsible, long-term investing

Responsible Motivation

Engagement cues that motivate action without encouraging risky behavior

Transparent Rewards

Transparency around how rewards, levels, and milestones are earned

Trust by Design

Trustworthy experiences that align with personal values and regulatory safeguards

Features & Functionalities Addressing User Needs

To directly support the identified user needs around trust, clarity, and responsible motivation, the product team implemented the following features

Tiered Membership Levels

Clear levels with defined criteria gave users visible progress tied to responsible investing actions—not trading frequency or performance

Progress Bars & Indicators

Persistent progress indicators showed users where they stand and what’s required next, reinforcing long-term commitment over short-term wins

Transparent Requirements

Each level surfaced explicit requirements and milestones, removing ambiguity around how progress and rewards are earned

Service-Based Rewards

Higher tiers unlocked access-based benefits (e.g. advisor access) rather than financial incentives, preserving trust and compliance

Gamification in Onboarding

New users were introduced to progress and purpose from day one, setting expectations early and aligning motivation with stewardship

Compliance-Reviewed

All labels, rewards, and interactions were vetted with compliance to ensure clarity, avoid implied guarantees, and protect user trust

High Fidelity Screens

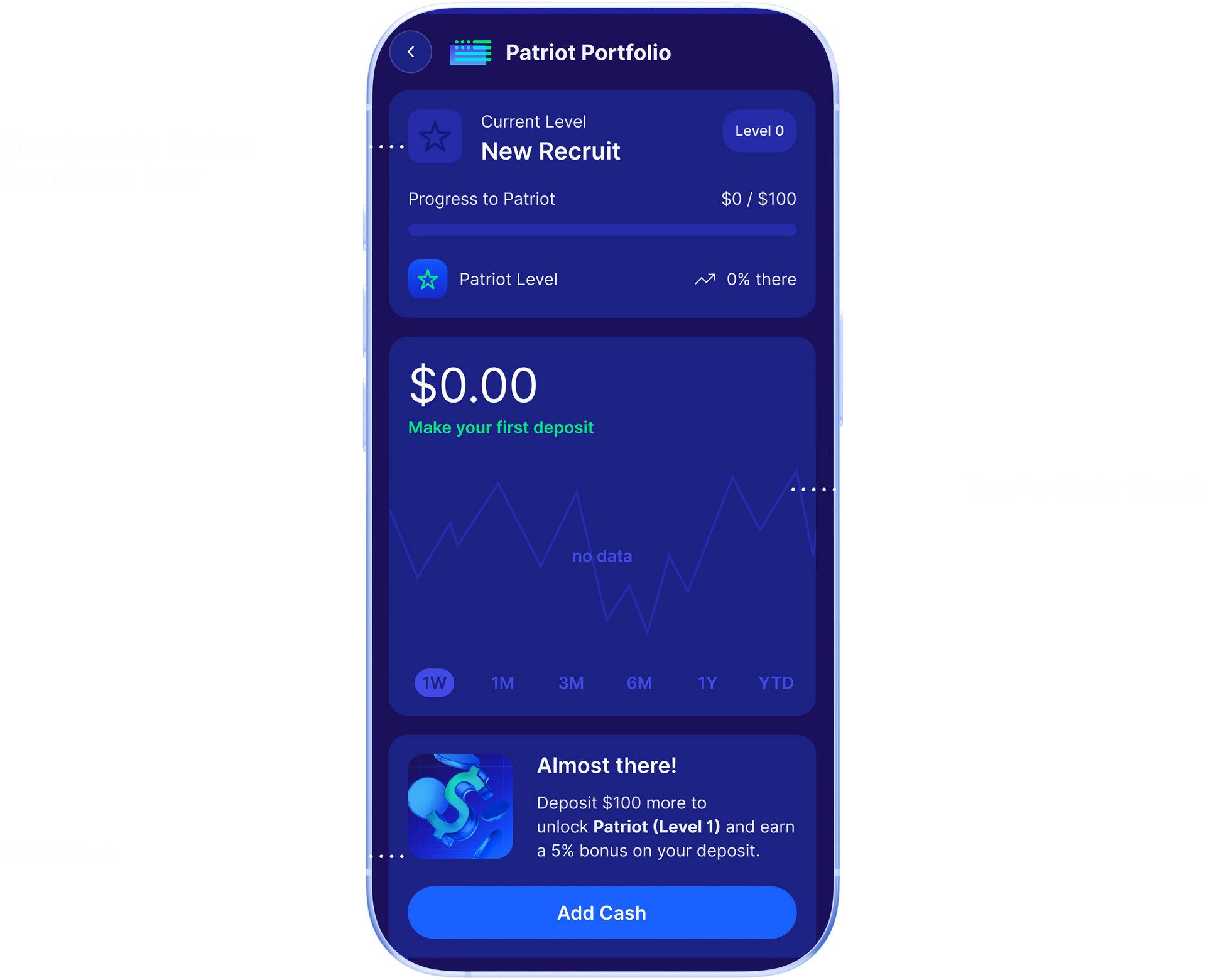

The user has deposited $100 – $999 in their Patriot Portfolio, and is incentivized to advance to the next level

When the user scrolls down, they can see that they have unlocked the first membership level

Scrolling further, the user sees a full Transaction history, including their 5% bonus reward

The user deposits another $2000, qualifying them for the next level

The user sees Their current membership level has gone up to Liberty Builder. The progress bar illustrates how far to the next

The user sees a full Transaction history, including their 5% bonus reward and their $50 reward

outcome

The gamification framework delivered a validated, compliance-ready design system that increased clarity, motivation, and long-term engagement intent without encouraging risky behavior. By strengthening Monorail’s product foundation and aligning engagement with trust and scalability, the work helped position the app for a successful acquisition at a profit.

Let’s talk about your project

Fill in the form or call to set up a meeting at (315) 530-5269 or email me at gregorylifanov@gmail.com