Monorail Investment Analyzer

Product Manager Case Study

problem statement

Most investors hold legacy brokerage accounts without understanding how holdings align with personal values. Monorail needed a compliant, scalable analyzer that revealed portfolio impact clearly, earned trust through inspection, and guided users from insight to action without gimmicks or misleading financial claims during regulated fintech decision-making.

Objectives

- Make portfolio impact understandable and actionable for mainstream investors

- Build trust through compliance-aware language, transparency, and inspectable data

- Convert insight into action without manipulation, pressure, or incentives

Goals

- Enable scalable analysis for portfolios containing hundreds of holdings

- Design progressive disclosure from scores to underlying holding sources

- Create a repeatable analyzer pattern reusable across scoring updates

my process

From Vision to Execution

Define the Constraints

Aligned product, design, engineering, and compliance early to define trust, regulatory, and scalability constraints

Design Disclosure

Structured experiences from simple scores to deep inspection, balancing clarity, credibility, and user interpretation

Guide Conversion

Delivered reusable patterns embedded into core flows, enabling the framework to scale with minimal rework

Qualitative Research & Ideation

We analyzed competitor analyzers, whiteboarded patterns, used AI ideation, and ran cross-functional workshops to identify trustworthy mechanics and avoid manipulative behaviors.

Key Observations

- Many investing apps use urgency-driven gamification that increases engagement but undermines trust in regulated financial contexts.

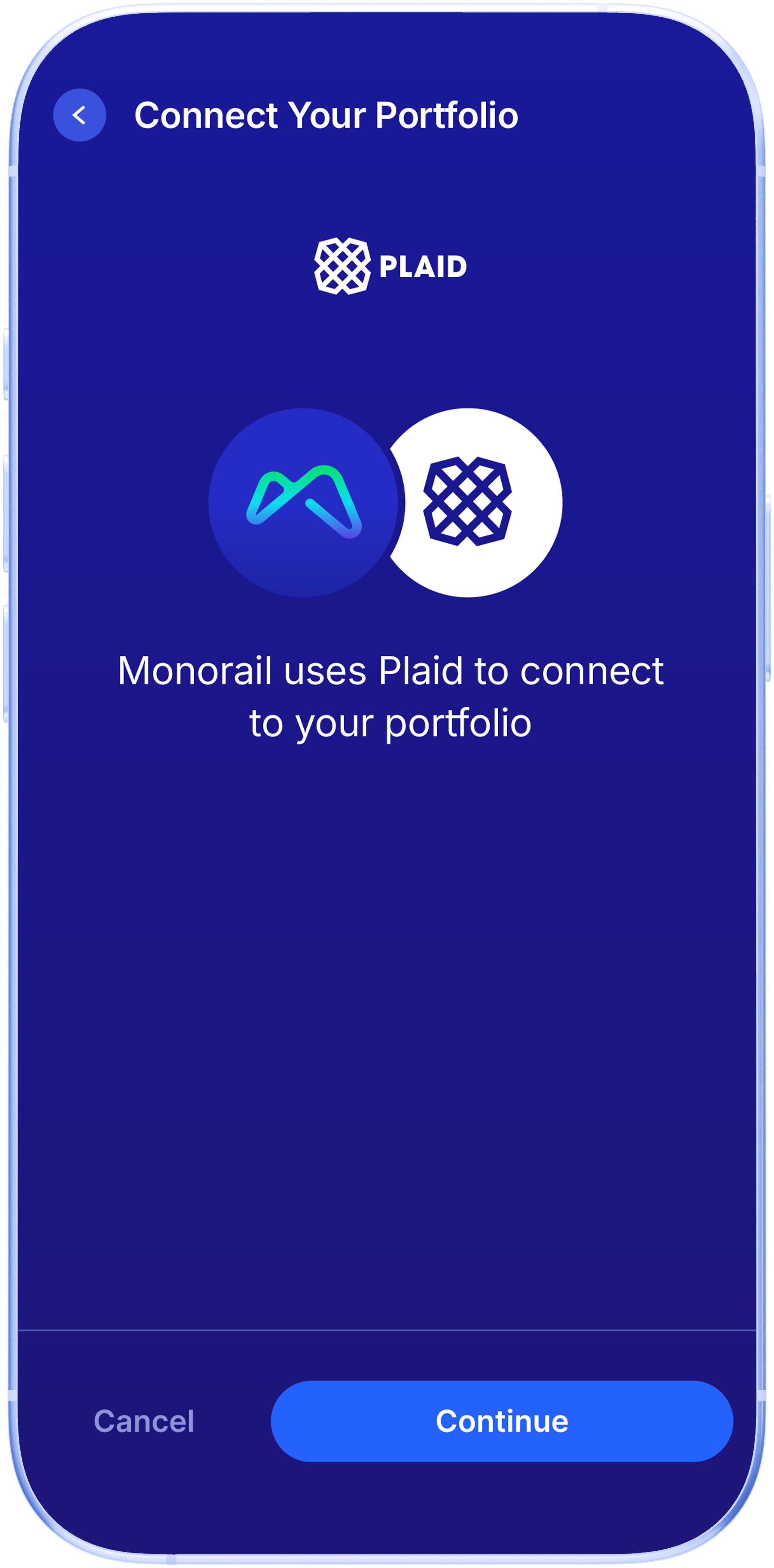

- Users respond better to familiar connection patterns, such as Plaid-style flows, when sensitive financial data is involved.

- Screens that lead with a clear summary metric reduce cognitive load and encourage deeper exploration.

- Excessive pagination and dense lists create friction when reviewing large portfolios on mobile.

Inferences

- Trust-first interaction patterns are more effective than novelty in high-stakes financial decisions.

- Progressive disclosure balances credibility and usability by letting users earn depth over time.

- Compliance-aware language and tooltips prevent misinterpretation without harming conversion.

- Simplified navigation outperforms traditional pagination for large financial datasets.

user needs

User Needs, Clearly Defined

Instant Clarity

Users need to quickly understand portfolio alignment without financial jargon or complex explanations slowing comprehension

Credible Depth

Users want the ability to inspect scores down to holdings, categories, and sources to verify trustworthiness

Compliant Transparency

Users need clear language, dated assessments, and explanations that prevent misunderstanding and meet regulatory expectations

Guided Action

Users need a clear, pressure-free path from insight to next steps without feeling manipulated or misled

Features & Functionalities Addressing User Needs

Each feature directly maps user needs to clarity, trust, scalability, and compliant conversion.

Plaid Connection

Secure brokerage connections using familiar Plaid patterns reduce friction, increase trust, and encourage completion for new and existing users

Dated Assessments

Each analysis is timestamped, clarifying data accuracy, preventing confusion, and supporting repeat checks over time for users

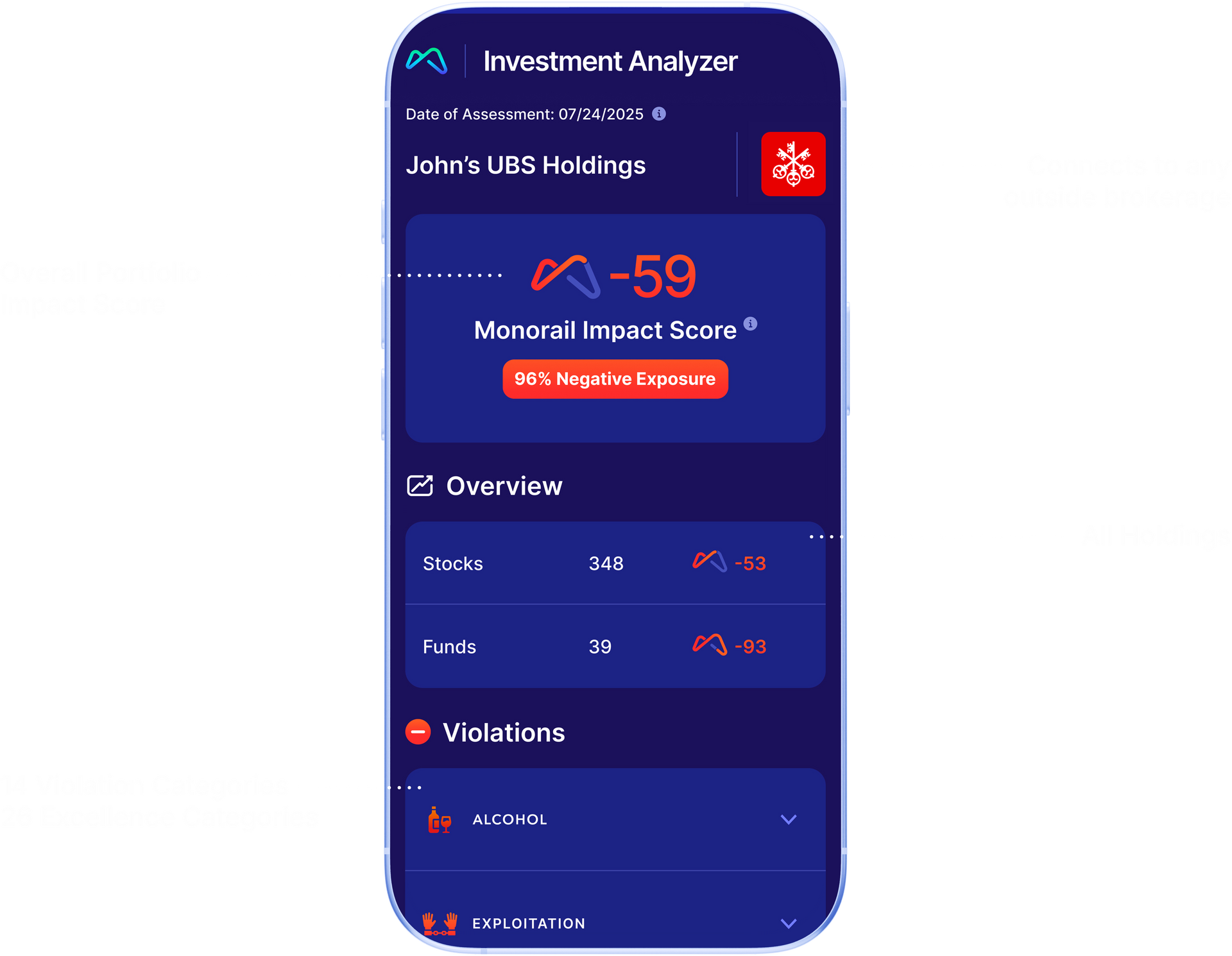

Impact Scoring

A single headline metric summarizes alignment, while progressive disclosure enables users to inspect categories, holdings, and sources

Violation Drilldowns

Expandable categories and detailed holding views help users understand specific conflicts without overwhelming or hiding critical information during portfolio review

Smart Navigation

Filters, sorting, and preview screens replace pagination, enabling fast exploration of large portfolios on mobile without performance issues or confusion

Conversion Bridge

Sticky calls-to-action guide next steps, activating Patriot Portfolios while respecting user intent, choice, and compliance boundaries during high-trust decision moments

High Fidelity Screens

The user can drill down to view details on specific violations

The user's portfolio has no violations, with several excellence companies

The user’s holdings qualify for multiple excellence categories

The user connects their outside portfolio securely via Plaid

The user can drill down to view details on specific companies

With the user's outside holdings portfolio connected, the Monorail app can easily ask if the user would like to transfer to Monorail

outcome

The Investment Analyzer became a powerful lead magnet, driving thousands of new users and an substantial increase in assets under management in 2025 through ads, onboarding, and sharing. By pairing trust-first design with scalable architecture and conversion clarity, the product strengthened Monorail’s growth narrative and supported the company’s successful acquisition at a profit goal.

Let’s talk about your project

Fill in the form or call to set up a meeting at (315) 530-5269 or email me at gregorylifanov@gmail.com